Handbook

Vietnam’s Economic Picture in 2023 and Forecast for 2024

Vietnam’s economic outlook for 2024 shows promising signs of improvement compared to 2023. In the final months of 2023, most socio-economic indicators in Vietnam demonstrated positive fluctuations, and macroeconomic stability was maintained.

Vietnam’s economy is projected to have several bright spots in 2024. Illustrative image: Internet.

Summary: The Vietnamese economy in 2023 faced numerous difficulties and challenges both domestically and internationally, particularly amid the volatile global economic context. Vietnam’s GDP growth in 2023 fell short of the government’s initial target and lagged behind the growth rate of 2022. Additionally, export-import activities encountered obstacles due to the unfavorable economic performance of many major countries worldwide. Nevertheless, the Vietnamese economy exhibited positive aspects throughout the past year, driven by various policies aimed at overcoming challenges, stimulating economic growth, and developing the financial market. Inflation was effectively controlled, FDI attraction and disbursement demonstrated positive growth, public investment disbursement increased significantly, foreign affairs and integration achieved notable successes, and Vietnam’s standing and prestige continued to rise.

Vietnam’s Economic Picture in 2023

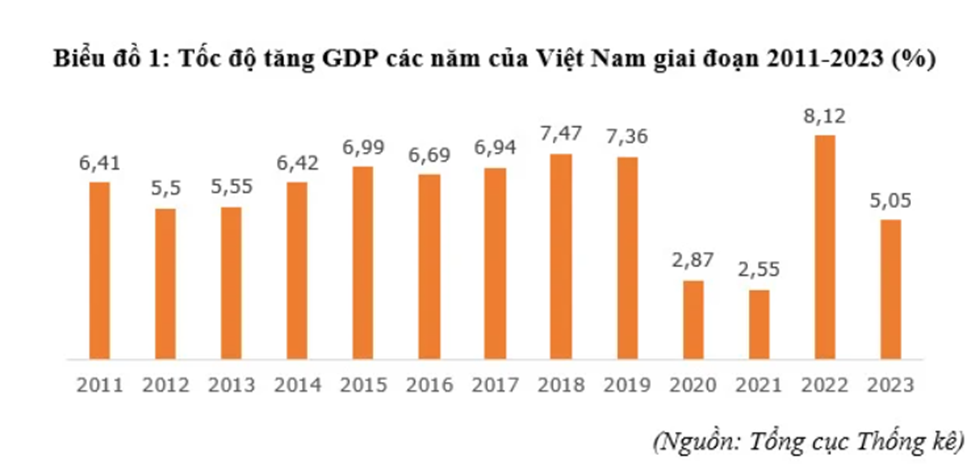

Vietnam’s GDP in 2023 is estimated to have grown by 5.05% compared to the previous year, significantly lower than in 2022 and only marginally higher than the growth rates of 2020 and 2021. Within the overall increase in total added value across the economy, the service sector recorded the highest growth rate (6.82%), contributing most to overall GDP growth (62.29%). The GDP scale at current prices in 2023 is estimated at VND 10,221.8 trillion, equivalent to USD 430 billion. GDP per capita in current prices in 2023 is estimated at VND 101.9 million per person, equivalent to USD 4,284.5, representing an increase of USD 160 compared to 2022.

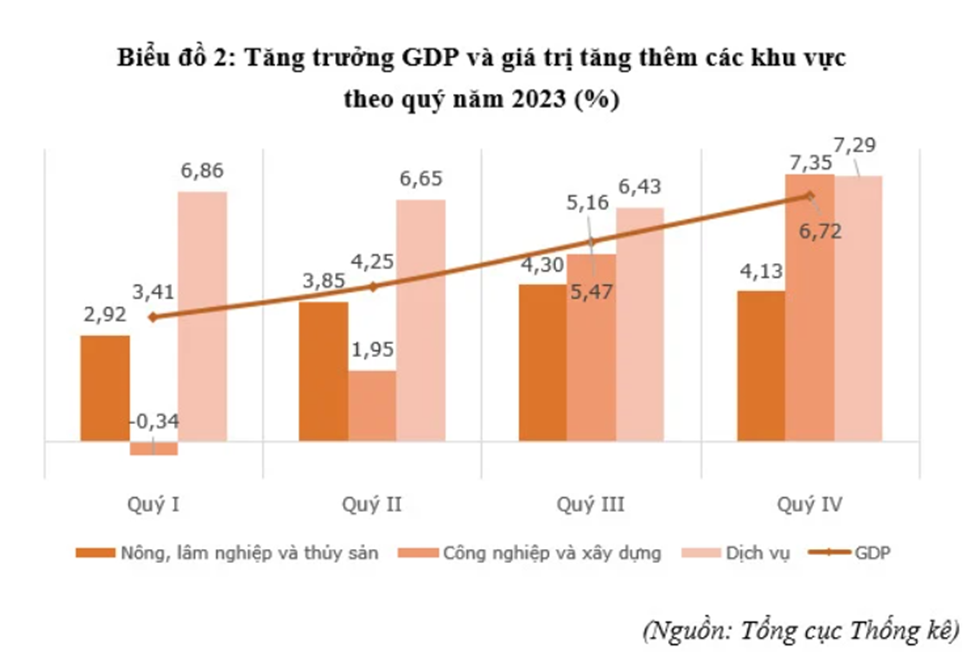

Specifically, in the fourth quarter of 2023, GDP is estimated to have grown by 6.72% compared to the same period in the previous year, exceeding the fourth quarter of 2012-2013 and 2020-2022, and with a positive trend of higher growth in subsequent quarters. The agriculture, forestry, and fisheries; industry and construction; and service sectors recorded specific growth rates as shown in Figure 18, with the service sector contributing most to GDP growth (49.91%).

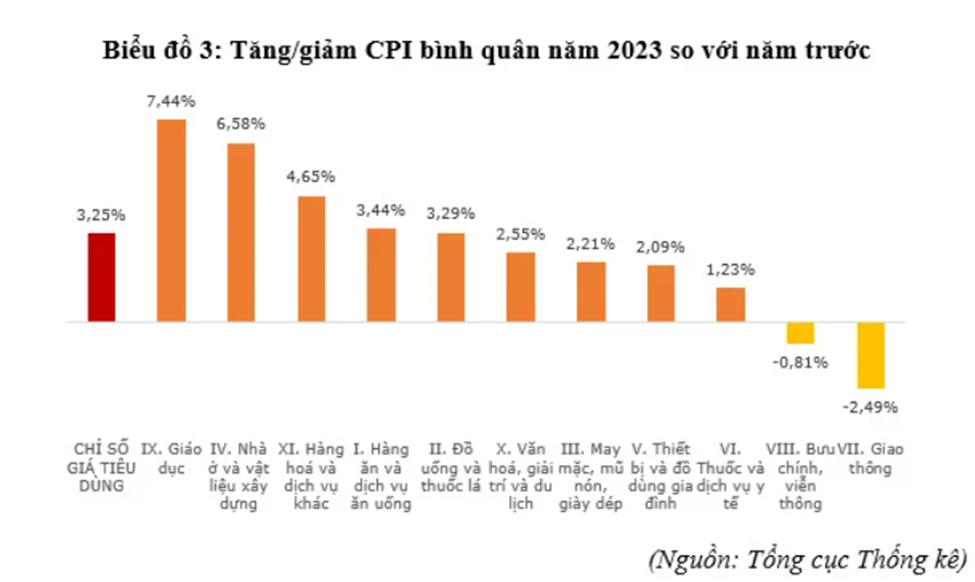

The average Consumer Price Index (CPI) in 2023 increased by 3.25% compared to 2022, significantly lower than the annual target of 4.5%. The average CPI increased by 3.54% in the fourth quarter of 2023 compared to the same period in 2022. The increase in the average CPI for 2023 compared to the previous year was primarily due to rising prices in sectors and items such as education, housing and construction materials, food, household electricity, beverages and tobacco, pharmaceuticals, and medical services. Additionally, several factors contributed to curbing the CPI growth rate in 2023, including the decline in the price index for gasoline, gas, postal, and telecommunications services. Furthermore, the government has decisively directed ministries, sectors, and localities to implement comprehensive price stabilization measures, mitigating negative impacts on socio-economic development and helping to control inflation in 2023.

On average, core inflation in 2023 increased by 4.16% compared to 2022, higher than the overall average CPI increase (3.25%). This was mainly due to a decrease in average domestic gasoline and oil prices by 11.02% and gas prices by 6.94% compared to the previous year, which curbed the CPI growth rate but fell within the category of goods excluded from the core inflation calculation.

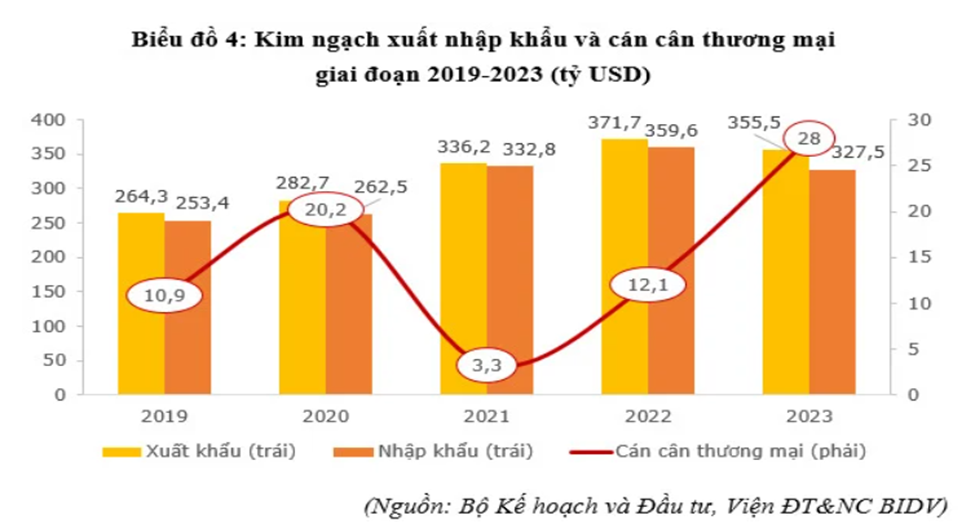

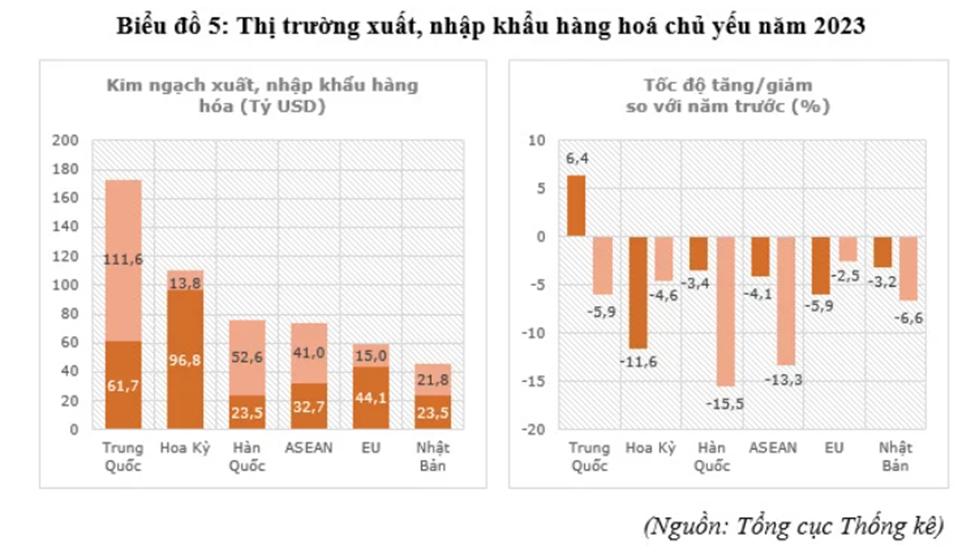

The business sector witnessed positive developments in the second half of 2023. According to the Ministry of Planning and Investment, the number of newly registered enterprises in 2023 reached a record high, with nearly 160,000 enterprises, 1.2 times the average for the period 2017-2022 and a 4.6% increase compared to the full-year estimate. The number of enterprises joining and rejoining the market increased by 4.5% compared to the same period in 2022, 1.3 times the number of enterprises withdrawing from the market in 2023. This indicates a restructuring within the business sector, while business confidence remained strengthened. Regarding exports and imports, for the entire year of 2023, total export and import turnover is estimated at USD 683 billion, down 6.6% compared to the previous year, with exports decreasing by 4.4% and imports by 8.9%. The trade balance in 2023 is estimated to have a surplus of USD 28 billion (compared to a surplus of USD 12.1 billion in the previous year). Of this, the domestic economic sector recorded a trade deficit of USD 21.74 billion, while the foreign-invested sector (including crude oil) recorded a trade surplus of USD 49.74 billion. In terms of export and import markets in 2023, the United States was Vietnam’s largest export market with an estimated turnover of USD 96.8 billion, and China was Vietnam’s largest import market with an estimated turnover of USD 111.6 billion. In 2023, the trade surplus with many markets tended to decrease compared to the previous year, including the United States, EU, China, South Korea, and ASEAN; the trade surplus with Japan, however, experienced strong growth, increasing by approximately 90.3% compared to the previous year.

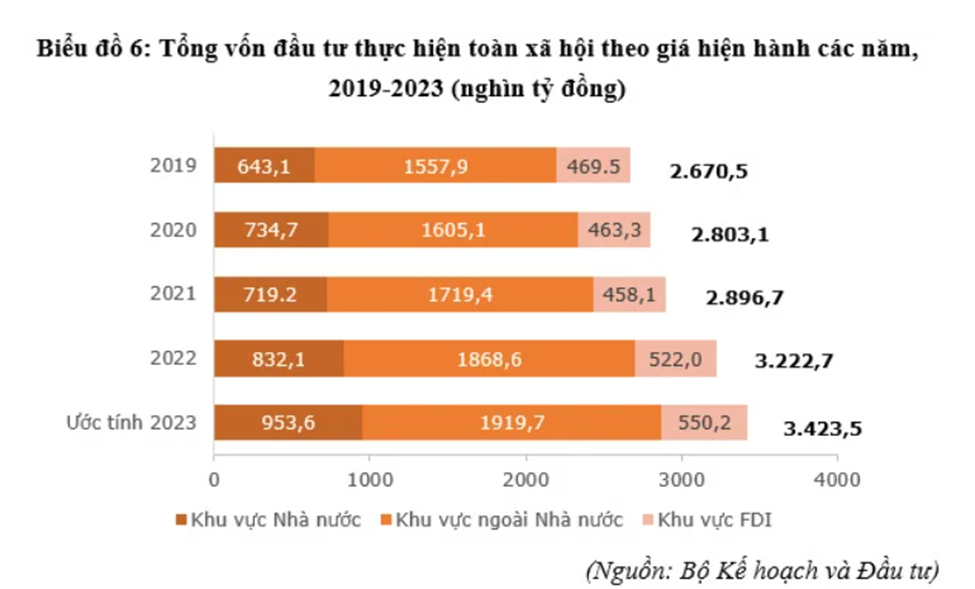

Regarding total social investment, in 2023, total social investment at current prices is estimated at VND 3,423.5 trillion, up 6.2% compared to the previous year, with the state sector accounting for 27.8% of the total and increasing by 14.6%; the non-state sector accounting for 56.1% and increasing by 2.7%; and the foreign direct investment sector accounting for 16% and increasing by 5.4%.

Total registered foreign investment in Vietnam in 2023, including newly registered capital, adjusted registered capital, and capital contributions and share purchases by foreign investors, reached nearly USD 36.6 billion, up 32.1% compared to the previous year, mainly due to a sharp increase in newly registered capital (56.6%) with nearly 3,200 newly licensed projects (up 62.2%) with many large-scale projects (hundreds of millions of USD to USD 1.5 billion) from the United States, Singapore, China, South Korea, etc. Foreign direct investment (FDI) disbursed in Vietnam in 2023 is estimated at USD 23.2 billion, up 3.5% compared to the previous year, marking the highest FDI disbursement in the past five years. Of this, the manufacturing and processing sector accounted for USD 19.08 billion, representing the largest proportion (82.3%) of total FDI disbursement.

Vietnam Economic Forecast for 2024

The economic outlook for Vietnam in 2024 shows promising signs of improvement compared to 2023. In the final months of 2023, most of Vietnam’s socio-economic indicators experienced positive fluctuations, and macroeconomic stability was maintained. Inflation was controlled, and growth was driven by the current recovery momentum, strong government measures, and gradually improving global economic prospects. With the ongoing economic recovery, decisive actions by the government and leaders at all levels, and the increasingly positive outlook for the global economy, Vietnam’s economy is forecast to recover better in 2024, potentially reaching a growth rate of 6-6.5% under the baseline scenario, in line with the government’s target.

Regarding inflation, in 2024, with the projected better economic recovery, improved money supply and circulation, while global inflation and prices (especially energy, food and basic materials, diseases, natural disasters, and geopolitical tensions remain complex and unpredictable) decline but remain high, Vietnam’s CPI is forecast to increase by about 3.5-4%, higher than in 2023 but within the permissible target. In addition, in 2024, some items under state management are also expected to continue to have their prices adjusted, such as increasing regional minimum wages, tuition fees, electricity prices continuing to increase, and medical service prices may also increase sharply due to the recent proposal by the Ministry of Health to change the way hospital fees are calculated. This situation could put pressure on inflation. However, the management agencies may calculate the dosage and timing of price adjustments for electricity, medical services, and education in line with the inflation control target.

However, in 2024, the domestic and global economy may still face other unforeseen difficulties and challenges. Although organizations highly appreciate the resilience of the Vietnamese economy, there are still some factors that may have a negative impact. For example, challenges from fluctuations in energy and electricity prices could put pressure on inflation; or unpredictable fluctuations in the financial and banking sector could affect the stability of interest rates and exchange rates. In addition, export activities will also continue to face many difficulties in the coming time, as the global economy is entering a period of high risk; the risk of economic recession, inflation, and interest rates remaining high is causing a sharp decline in consumer demand in countries around the world, including Europe and America, which are major trading partners of Vietnam, along with the trend of shifting supply sources closer to consumption markets. Thus, if the difficulties of the economy such as declining domestic purchasing power, export orders not recovering as expected, and support capital not reaching businesses persist in 2024, the number of businesses withdrawing from the market could continue to increase, thereby reducing the overall production and business efficiency of the economy. Therefore, maintaining economic stability still requires sensitivity and flexibility from policymakers and state management agencies.

Source: https://stockbiz.vn/

Có thể bạn quan tâm

Holiday Announcement: Hung Kings’ Commemoration Day, Reunification Day (April 30) & International Labor Day (May 1)

Apr

Thuận Hưng Long An Year-End Party 2025 – Connecting Success, Shining the Future

Jan

ESG: A Sustainable Pathway for Garment Industry

Dec

Fire Drill at THLA – Enhancing Safety and Preparedness

Nov